6 Easy Facts About Motorcycle Insurance Cincinnati Shown

Wiki Article

The Facts About Cincinnati Insurance Company Uncovered

Table of Contents9 Easy Facts About Auto Insurance Cincinnati Explained7 Simple Techniques For Cincinnati Insurance CompanyThe smart Trick of Auto Insurance Cincinnati That Nobody is DiscussingA Biased View of Motorcycle Insurance CincinnatiBoat Insurance Cincinnati Fundamentals ExplainedGetting My Motorcycle Insurance Cincinnati To Work

Automobile insurance coverage has you covered when accidents take place. Let's state you go to a red light and a sidetracked motorist stops working to drop in time and also hits the back of your car. If you didn't have auto insurance coverage, you would need to pay of pocket for any type of damage to the automobile.Car insurance coverage functions by offering economic protection for you in the occasion of an accident or theft. Auto insurance policy premiums have a look at a number of variables based on you, your lorry as well as your driving background. Several of which may include: Driving document Basically, the far better your driving record, the lower your costs.

Vehicle insurance policy safeguards not only you, yet likewise travelers, other chauffeurs, and also pedestrians. How much insurance as well as what kind of protections you need will depend on your circumstance.

Motorcycle Insurance Cincinnati for Dummies

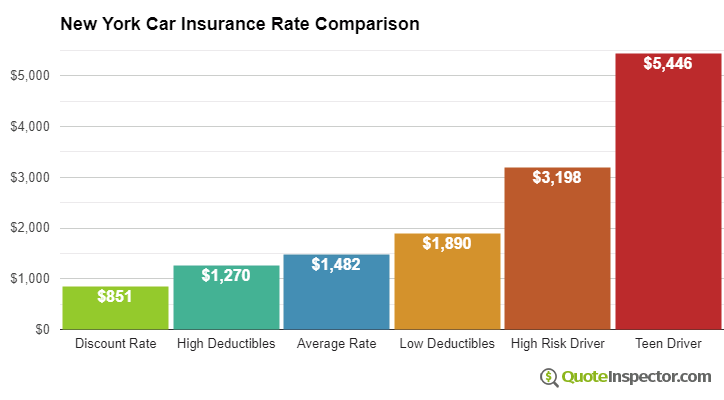

It does not spend for bodily injury you may sustain. Building damage, This protection protects you if you are at mistake for damages to another person's property, such as a cars and truck, its contents, or other building you damage in a mishap such as a garage, residence, fence, or trailer. Medical repayments, Clinical payments protection spends for necessary treatment for you or others covered by your plan resulting from a mishap.A greater insurance deductible reduces the possibility that your standing with your insurance business will certainly be influenced. If you have a reduced insurance deductible which causes you to submit a number of little insurance claims, your costs will likely increaseor your insurance coverage can even be terminated. Your capability to pay the insurance deductible is a crucial consideration when selecting a level that is ideal for you.

The 8-Second Trick For Boat Insurance Cincinnati

This discount program advantages those that have been guaranteed by WEA Building & Casualty Insurance Business for three or more years. This discount rate applies when a participant renews his or her policy.At Member Advantages, you select where you want to get your car repaired. Unlike numerous other insurance provider, we do not tell you where to get your vehicle repaired. It's "your Choice." We will forgo one speeding ticket or minor moving violation per insured household. Typically, the only time you hear from your insurer is when your costs schedules.

We conduct periodic policy assesses that aid you discover how changes in your personal life may influence your insurance policy needs. We appreciate your commitment. If you are in a mishap and also you have been insured with us for 5 or even more years without previous crashes or tickets in the house, we will waive the accident surcharge.

Cincinnati Insurance Company Can Be Fun For Everyone

If you injure someone with your automobile, you might be filed a claim against for a whole lot of money. The quantity of Responsibility insurance coverage you bring must be high sufficient to secure your properties in the occasion of an accident. Many professionals advise a restriction of a minimum of $100,000/$300,000, yet that might not be enough.

If you have a million-dollar residence, you could lose it in a claim if your insurance policy protection is not enough. You can obtain additional coverage with a Personal Umbrella or Personal Excess Liability policy (auto insurance Cincinnati). The better the worth of your assets, the more you stand to lose, so you need to purchase obligation insurance policy appropriate to the value of your assets.

The Best Strategy To Use For Auto Insurance Cincinnati

You don't have to find out how much to buy that depends on the automobile(s) you guarantee. However you do need to choose whether to get it as well as how large a deductible to take. The higher the deductible, the lower your costs will certainly be. Deductibles generally vary from $250 to $1,000.

Comprehensive protection is normally offered with each other with Accident, as well as the two are typically referred to together as Physical Damage coverage. more helpful hints If the automobile is leased or financed, the renting firm or lender might require you to have Physical Damage protection, despite the fact that the state law may not require it. Covers the cost of medical treatment for you as well as your guests in the occasion of a crash.

The Only Guide to Car Insurance Cincinnati

Therefore, if you pick a $2,000 Medical Expense Restriction, each passenger will certainly have up to find out this here $2,000 coverage for clinical claims arising from an accident in your automobile. If you are included in an accident as well as the other motorist is at fault however has also little or no insurance, this covers the void between your expenses and also the other motorist's coverage, as much as the restrictions of your coverage.Report this wiki page